10 Reasons Why Annuities Are Popular

Principal and Interest Earned is Guaranteed Against Loss

Here are 10 reasons why annuities are popular. There are more but here’s some of the most common reason.

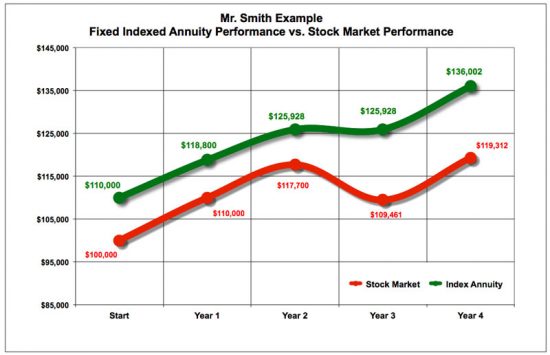

With a Fixed Index Annuity, your principal, earned interest, and any bonus you received are contractually guaranteed to never reduce in value. All gains are locked in, and this means you are guaranteed never to lose your money. This guarantee is an inherent advantage of Fixed Index Annuities over other financial instruments like stocks, bonds, mutual funds, and Variable Annuities. When you receive your annual Annuity statement, it is guaranteed to never show a loss or less value than the year before.

Between the years 2000 and 2008, twice in 8 years we have seen the unprecedented occurrence of the stock market losing between 40% – 50%. These financial losses devastated many private retirement funds. However, during the same 8-year period, people who held their money in Fixed Index Annuities weathered those economic storms with zero loss of their money! While stock market participants were experiencing massive losses, the annuitants experienced no financial loss!

Fixed Indexed Annuities Usually Pay a Premium Bonus

The insurance companies want your business. A premium bonus is usually offered to provide you an incentive to purchase a Fixed Index Annuity with their company. The bonus “gift” is given to you as a deposit into your Annuity account on the start date of your policy. You begin earning interest on the bonus along with your principal premium on day-one of your Annuity policy.

At first glance, it would seem logical that the company that is offering the most significant bonus would be the best Annuity. That may or may not be accurate. It is essential to look at the total picture and benefits of the Annuity to determine which product is best for you. A licensed Annuity Advisor can assist you in navigating through the various products that are available and help you select which Annuity is best for your situation.

Your Earnings Can Be Tied to Stock Market Index Performance Without Stock Market Risk

Fixed Index Annuities are designed to allow you to safely (without risk of your principal or interest earned) participate in a portion of the upside gain of the stock market while insulating your money from the downside risk of the stock market. When the stock market index goes up in value, you participate in a portion of the gain. When the stock market index goes down or experiences a loss, your earned interest is locked-in, and you are not burdened with any loss of your principal or previously gains. Many people who are weary of the constant up and down roller coaster of the stock market have found Fixed Index Annuities to be an extremely safe alternative retirement savings strategy.

Click the chart to learn more about Fixed Indexed Annuities.

Premium Bonus Guaranteed For 7 Years

There is an Annuity product offered that honors an 8% bonus for a 7 year period. For 7 years, you can contribute as much money as you like (up to $1 Million), and as often as you like, and every new contribution will also receive an 8% bonus. This has been a considerable benefit that many annuitants have enjoyed as it enables them to have a 401k type of savings that continues to provide matching funds.

Guaranteed Growth

Many Fixed Indexed Annuities have an option called an Income Rider. They are also known as “Hybrid Annuities.” The income rider is usually a fee based option designed to provide lifetime income. While in its tax-deferral period, grows at a guaranteed fixed rate every single year. Typically, the fixed rate ranges from 5% to as much as 10% simple interest. Depending on the Annuity, the growth can be calculated as simple or compounded interest. Usually, the insurance company allows for an income rider growth period of 10 years or more, and in some cases, for the lifetime.

It is important to not confuse the Income Rider Value with the Annuity Account Value. They are separate column ledgers and the growth for each are usually separate and quite different. Be sure to ask your advisor how each column grows and what are the features, benefits, and options.

An Annuity with an Income Rider provides an enormous amount of flexibility. For example, although it does provide a guaranteed lifetime income that you cannot outlive, unlike annuitization it also enables you to begin or stop payments at any time you wish. At any time, this flexibility also allows you to withdraw a lump sum of cash from the account value in your Annuity. At any time you die any money remaining in the Account Value is inheritable to your beneficiaries.

Due to the guaranteed rate of growth offered by the insurance companies, the income account value in an income rider can double in 7 to 10 years, and quadruple in 14 to 20 years. This is extremely important for people who intend to use the money as a guaranteed income stream they cannot outlive, or are concerned with leaving an enhanced death benefit to heirs.

It’s a Myth That Fixed Indexed Annuities Tie Up All Your Money

There are some FIAs that provide 100% liquidity of your initial premium. At the minimum, most others allow access without any fees or penalties up to 10% of your accumulated value. The 10% free withdrawal can be accessed every year through the surrender period. Most allow full access without penalty if you have a medical emergency like a terminal illness and all allow full access upon death. If you require nursing care, many allow full access without penalty or can be accessed with a larger free withdrawal percentage that usually doubles to 20%.

Your Account Grows Tax-Deferred

The advantage of tax-deferral is that instead of paying taxes on your earnings, the money is not taxed until funds are permanently withdrawn. What that means to you is your money compounds more quickly because it is used to help your account value grow instead of being used to pay income taxes. The tax deferral growth results in a significant advantage as the growth is accelerated with greater earnings velocity.

Death Benefits

Upon the death of the Annuity owner, some Annuities have an optional feature that can enhance the Account Value, so the beneficiaries receive more money than the Annuity’s current value. Some allow a choice between receiving the Account Value or the Income Rider Value, whichever is greatest.

Nursing Care and Confinement Riders

Some Fixed and Fixed Indexed Annuities can provide money to help pay for Nursing Care, or a Nursing Home, or both. This feature is an excellent benefit for people that cannot afford expensive Long Term Care Insurance. Some products provide a doubling of income to help pay nursing care expenses. For example, suppose you are receiving $25,000/year as an Annuity payment. If you require nursing care (even in your home), the payment can double to $50,000/year for as long as nursing care is needed or up to when the account value is exhausted. However, it is important to note that if nursing care depletes the account, the payment which is guaranteed for life reverts to the original amount which in our hypothetical example is $25,000/year.

Ideal for Roth IRAs, SEP IRAs, and Traditional IRAs

You can transfer Roth IRAs, SEP IRAs, and Traditional IRAs into an Annuity without triggering any taxable event, and without any tax liability. Fixed and Fixed Index Annuities also work very well with 401k and other retirement accounts as they continue as either tax-free or tax-deferred accounts.

Today’s modern Annuities have many features that allow them to be customized for most retirement situations. If you are interested in learning more about how an Annuity can provide you secure and guaranteed retirement income, allow us to connect you to a licensed Annuity Advisor in your area. If you are not ready to speak to an advisor, please use the resources here on AnnuitySeeker to learn more about these safe retirement products.

Learn More

- 10 Reasons Why Annuities Are Popular

- Annuity Calculators and Best Annuity Rates

- Annuity Videos

- Biggest Fears About Annuities

- Fixed & Variable Annuities Explained

- Fixed Annuities Disadvantages

- Fixed Index Annuities Explained

- Guide to Fixed Annuities

- How Does The Interest Calculation In Fixed Index Annuities Work

- How Fixed Index Annuities Compare To Other Financial Products

- Immediate & Deferred Annuities Explained

- Industry Opinions

- Is An Annuity Right For Me?

- Liquidity And Access To Your Money

- Popularity of Annuities

- Pros and Cons of An Annuity

- Tax Free Retirement Payments

- What is an Annuity Surrender Charge?

- What is an Annuity? How Do Annuities Work?

- What to Expect In Your First Meeting With Your Annuity Sales Advisor

Annuity Education Links